Paul B Insurance for Beginners

Out-of-pocket costs (that is, sets you back besides your monthly costs) are an additional essential factor to consider. A plan's summary of benefits should plainly lay out just how much you'll have to pay of pocket for services. The government online market offers photos of these expenses for comparison, as do many state industries.

Coinsurance: This is the percent (such as 20%) of a medical cost that you pay; the rest is covered by your health and wellness insurance coverage plan. Insurance deductible: This is the quantity you pay for protected clinical care prior to your insurance begins paying. Out-of-pocket maximum: This is one of the most you'll pay in one year, out of your very own pocket, for covered healthcare.

Out-of-pocket prices: These are all prices above a plan's premium that you should pay, including copays, coinsurance and deductibles. Costs: This is the month-to-month amount you spend for your health insurance policy plan. As a whole, the higher your premium, the lower your out-of-pocket prices such as copays as well as coinsurance (and also vice versa).

By this step, you'll likely have your choices limited to simply a few plans. Below are some points to take into consideration following: Check the range of solutions, Return to that summary of advantages to see if any one of the strategies cover a larger range of solutions. Some might have better insurance coverage for points like physical therapy, fertility treatments or mental healthcare, while others may have far better emergency insurance coverage.

Paul B Insurance Things To Know Before You Get This

Sometimes, calling the strategies' customer support line might be the finest method to get your questions answered. Create your inquiries down beforehand, as well as have a pen or electronic device handy to tape-record the responses. Right here are some examples of what you might ask: I take a details medicine.

Make sure any kind of strategy you choose will certainly spend for your routine as well as needed treatment, like prescriptions as well as specialists.

As you're searching for the right medical insurance, a great step is to identify which intend type you require. Each plan type equilibriums your expenses as well as dangers in a different way. Think of your healthcare use and spending plan to locate the one that fits.

Medical insurance (additionally called wellness protection or a health and wellness plan) assists you spend for healthcare. All medical insurance strategies are different. Each plan sets you back a different quantity of cash and covers different solutions for you and also members of your family members. When choosing your insurance policy plan, take a while to consider your household's clinical demands for the next year.

Paul B Insurance Can Be Fun For Everyone

You can locate strategy summaries as well as obtain information regarding health insurance plan for you and also your youngsters in your state's Medical insurance Marketplace. This is an on the internet source set up by the Affordable Care Act that assists you find as well as compare health insurance in your state. Each strategy in the Market has a recap that includes what's covered for you and also your family members.

When contrasting medical insurance plans, consider these expenses to assist you decide if the strategy is best for you: This is the quantity of money you pay every month for insurance policy. This is the amount of money you have to spend prior to the strategy starts paying for your healthcare.

This is the amount of money you pay for each health and wellness treatment service, like a see to a health and wellness treatment carrier. This is the greatest quantity of money you would have to pay each year for wellness care services.

Right here's what to look for in a wellness strategy when you're considering providers: These suppliers have an agreement (contract) with a health insurance to give clinical solutions to you at a discount rate. In most cases, going to a recommended provider is the least costly way to obtain health treatment.

All About Paul B Insurance

This means a health insurance plan has different costs for various suppliers. You might have to pay more to see some carriers than others. If you or a family participant currently has a healthcare supplier as well as you want to keep seeing them, you can learn which intends consist of that company.

You can figure out what solutions are covered by each wellness strategy in the on-line Market. All plans need to cover Learn More Here prescriptions, however each Homepage plan covers them differently. A prescription is an order for medicine offered by a healthcare carrier. If you utilize prescription medication, blog here you can figure out what prescriptions are covered by each health plan in the on the internet Market.

There are numerous types of wellness insurance intends to choose from, and each has associated prices as well as restrictions on carriers as well as sees.

To obtain ahead of the video game, inspect your existing healthcare plan to assess your coverage as well as recognize your strategy. As well as, check out for more specific healthcare plan information.

Not known Details About Paul B Insurance

Medical facility cover is available in 4 various tiers, particularly Gold, Silver, Bronze, and Standard, each covering a mandated listing of therapies. Since Gold plans cover all 38 kinds of treatments laid out by the government, they additionally feature the most expensive costs.

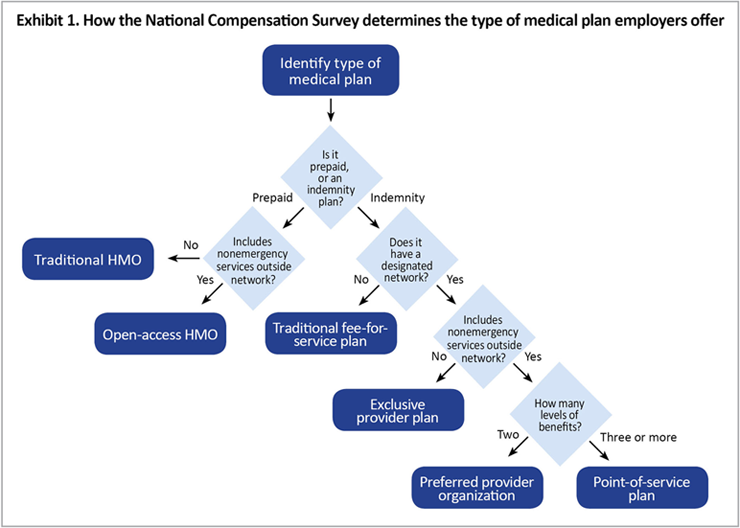

If it's an indemnity strategy, what kind? Is that HMO traditional, or open-access? With lots of strategy names so unclear, just how can we find out their kind? Given that the Bureau of Labor Stats (BLS) started reporting on medical plans over 30 years earlier, it has actually recognized them by kind. Obviously, strategies have actually altered a fair bit in three decades.

A plan that gets with clinical service providers, such as healthcare facilities and also doctors, to create a network. Patients pay much less if they utilize suppliers that belong to the network, or they can utilize service providers outside the network for a greater price. A strategy making up teams of medical facilities and also medical professionals that agreement to provide thorough medical solutions.

Such plans normally have varying insurance coverage levels, based on where service happens. The plan pays much more for solution carried out by a restricted set of providers, much less for solutions in a wide network of service providers, and also also less for solutions outside the network. A strategy that provides pre-paid comprehensive clinical treatment.

The Single Strategy To Use For Paul B Insurance

In Exhibit 2, side-by-side comparisons of the six kinds of healthcare plans reveal the differences identified by solution to the 4 inquiries about the plans' attributes. Point-of-service is the only plan kind that has even more than 2 levels of benefits, and also fee-for-service is the only type that does not use a network.

The NCS has not added plan types to represent these yet has categorized them into existing plan types. As in the past, the plan name alone may not recognize a distinct as well as consistent collection of functions. NCS does arrange details on some of these special plan features. In 2013, 30 percent of medical strategy individuals in exclusive industry were in plans with high deductibles, as well as of those employees, 42 percent had access to a health savings account.